Accumulation/Distribution, Advance/Decline, Arnaud Legoux Moving Average, Aroon,

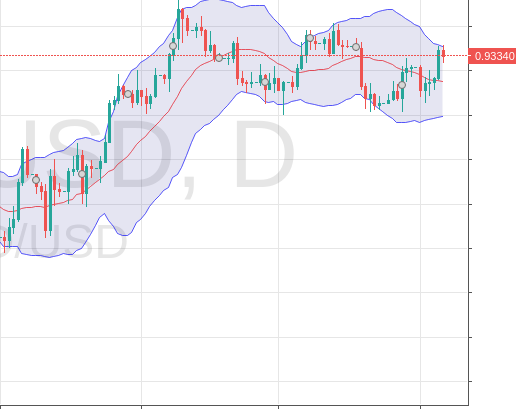

Average True Range, Awesome Oscillator, Balance of Power, Bollinger Bands, Bollinger Bands %B,

Bollinger Bands Width,

Chaikin Money Flow, Chaikin Oscillator, Chande Kroll Stop, Chande Momentum Oscillator, Choppiness

Index,

Commodity Channel Index, Coppock Curve, Correlation Coeff, Directional Movement Index,

Donchian Channels, Double Exponential Moving Average, Ease of Movement, Elders Force Index,

Envelope,

Hull MA, Ichimoku Cloud, Keltner Channels, Klinger Oscillator, Know Sure Thing,

Least Squares Moving Average, Linear Regression Curve, MA Cross, Mass Index, Momentum, Money Flow,

Moving Average, Moving Average Convergence/Divergence, Moving Average Exponential, Moving Average

Weighted,

Parabolic SAR, Price Oscillator,

Relative Strength Index, Relative Vigor Index, Relative Volatility Index, SMI Ergodic

Indicator/Oscillator,

Stochastic, Stochastic RSI, TRIX, Triple EMA, True Strength Indicator,

VWMA, Willams %R, Williams Alligator, Williams Fractals, Compare, Overlay, ZigZag