Backtesting Starter

Past performance might be indicative of future results. If your trading strategy's backtesting results are predominantly negative, the likelihood of continued negative trading outcomes is significantly higher.

Trading Strategy Development

This tutorial will guide you through the process of simple trading strategy development. A trading strategy is a set of rules or guidelines that a trader follows to make trading decisions.

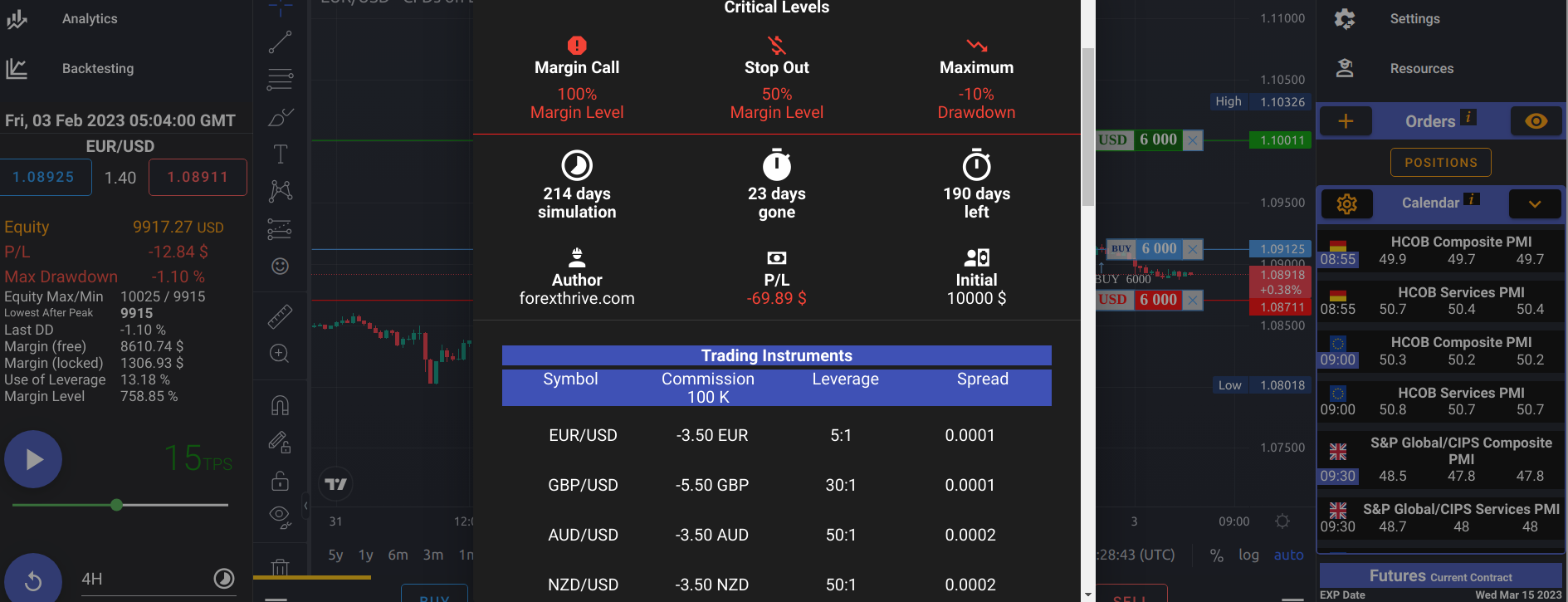

Trading Simulator Backtesting Essentials

Increase your ability to understand challenging information. Our latest application combine the entertaining and enjoyable excitement of games with the educational and evaluative benefits of simulation.

What is overnight financing fee or "SWAP"

Retail forex brokerage firms often charge or credit traders (valid for CFDs) with a swap rate when they hold a position overnight. This is also known as a rollover or overnight financing fee.

Understanding Trading Instruments

For many retail traders, the world of trading instruments is often confusing and misunderstood. Learn why trading is moving from bilateral OTC relationships towards a marketplace with more centralized price discovery and transparency.

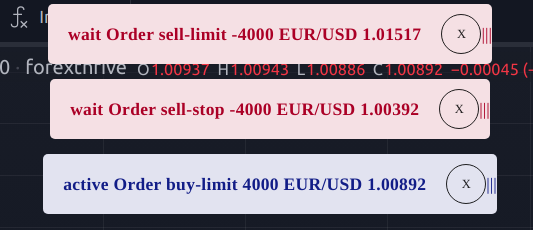

How to use Bracket Orders

A bracket order is a more comprehensive order type that consists of three separate orders: a market order, a limit order to take profits (profit-taking order), and a stop-loss order. You can try bracket orders in the simulator, learn how to back-test a strategy using conditional orders.

One Triggers Another (OTA) - Orders

"One Triggers Another" (OTA) is a type of conditional order commonly used in trading. OTA orders consist of two parts: the primary order and the secondary order. The primary order is the initial action you want to take, like a Limit Order to buy EUR/USD. The secondary order is a contingent action that is executed only if the primary order is filled. Try (OTA) orders in the simulator,